Where To Mail Form 5329

Where To Mail Form 5329 - Find out who must file, when and where. Box if mail is not delivered to your home. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Form by itself and not with your tax return. Home address (number and street), or p.o. Mail it to the address that a form 1040 without payment would go to for your state :

Form by itself and not with your tax return. Home address (number and street), or p.o. Box if mail is not delivered to your home. Find out who must file, when and where. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Mail it to the address that a form 1040 without payment would go to for your state :

Mail it to the address that a form 1040 without payment would go to for your state : Form by itself and not with your tax return. Home address (number and street), or p.o. Box if mail is not delivered to your home. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Find out who must file, when and where.

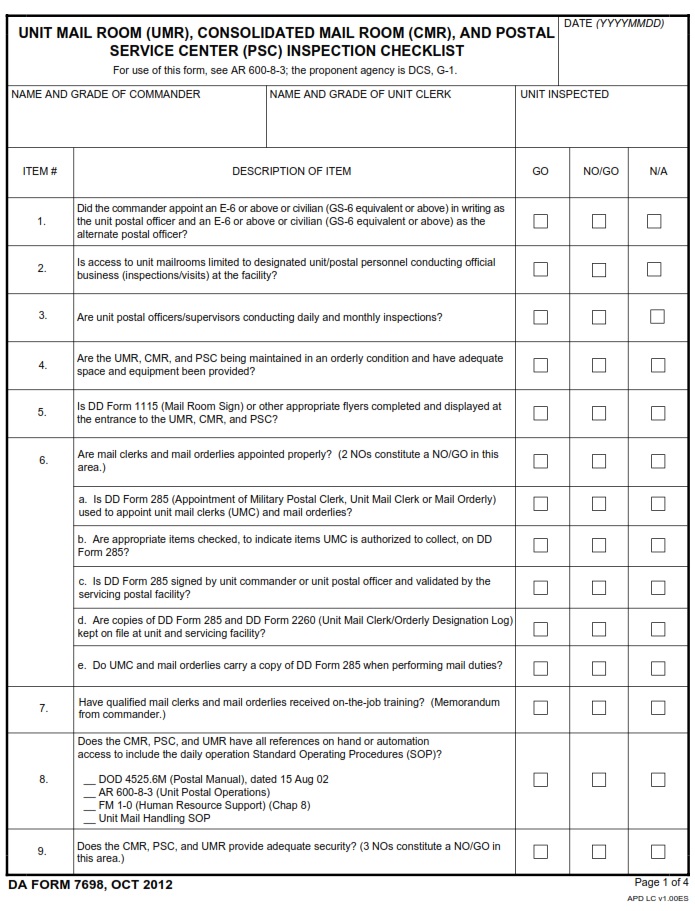

DA FORM 7698 Unit Mail Room (UMR), Consolidated Mail Room (CMR), And

Box if mail is not delivered to your home. Form by itself and not with your tax return. Find out who must file, when and where. Home address (number and street), or p.o. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond.

Fillable Online Postage Statement Standard Mail Form. Postage Statement

Form by itself and not with your tax return. Box if mail is not delivered to your home. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Home address (number and street), or p.o. Find out who must file, when and where.

How to Write Letter Address Knowdemia

Box if mail is not delivered to your home. Mail it to the address that a form 1040 without payment would go to for your state : Find out who must file, when and where. Home address (number and street), or p.o. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond.

Mail window. Template for new message with subject and user avatar

Mail it to the address that a form 1040 without payment would go to for your state : Form by itself and not with your tax return. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Box if mail is not delivered to your home. Find out who must file, when and.

how to send attached mail form azure devops Stack Overflow

Mail it to the address that a form 1040 without payment would go to for your state : Home address (number and street), or p.o. Form by itself and not with your tax return. Box if mail is not delivered to your home. Find out who must file, when and where.

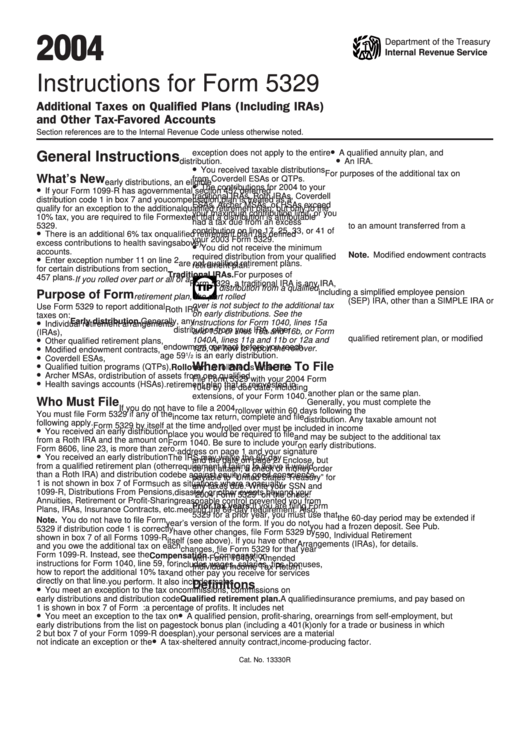

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Form by itself and not with your tax return. Box if mail is not delivered to your home. Mail it to the address that a form 1040 without payment would go to for your state : Home address (number and street), or p.o. Find out who must file, when and where.

DotnameKorea EMail form

Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Find out who must file, when and where. Mail it to the address that a form 1040 without payment would go to for your state : Home address (number and street), or p.o. Form by itself and not with your tax return.

IRS Form 5329 walkthrough (Additional Taxes on Qualified Plans and

Mail it to the address that a form 1040 without payment would go to for your state : Box if mail is not delivered to your home. Find out who must file, when and where. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Home address (number and street), or p.o.

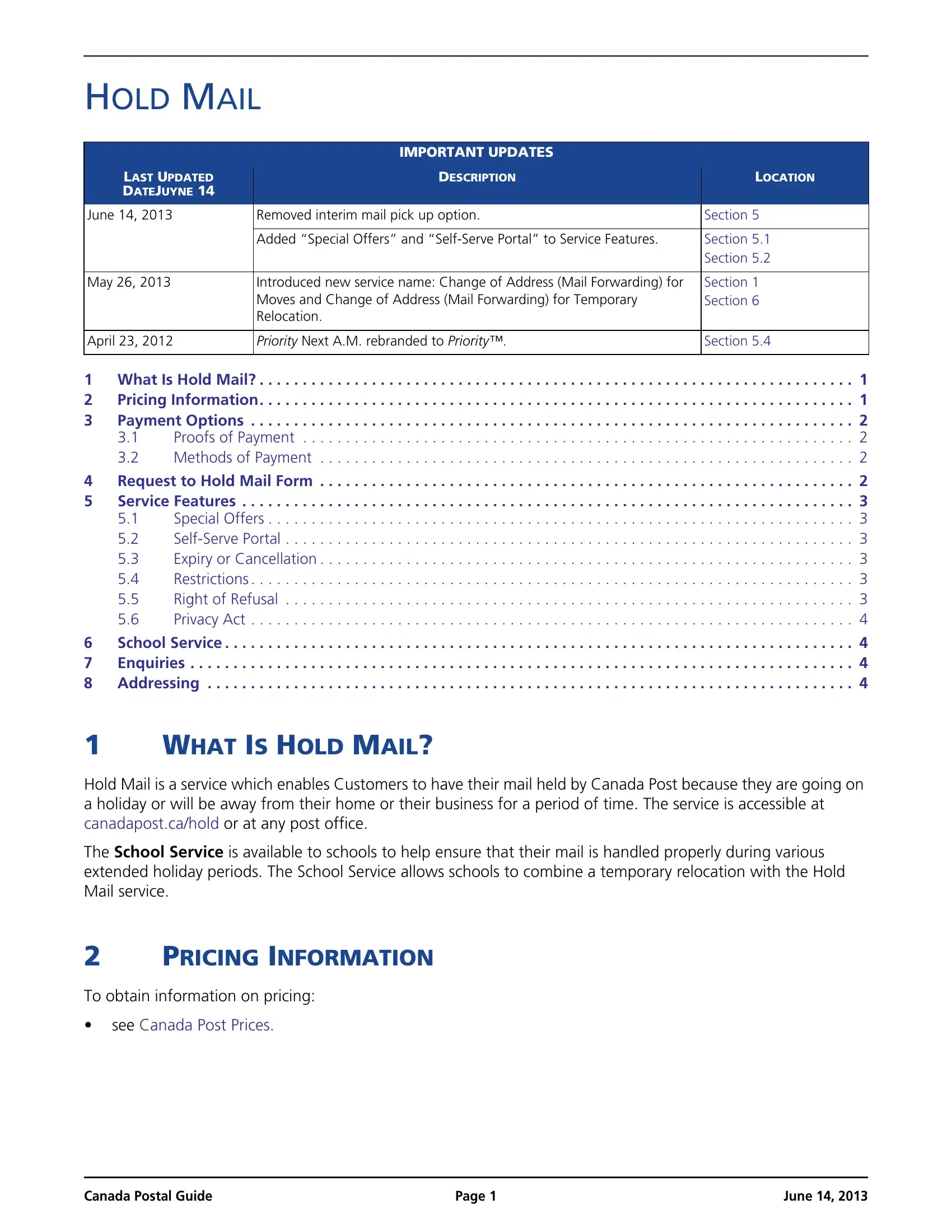

Hold Mail Form ≡ Fill Out Printable PDF Forms Online

Find out who must file, when and where. Mail it to the address that a form 1040 without payment would go to for your state : Form by itself and not with your tax return. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Home address (number and street), or p.o.

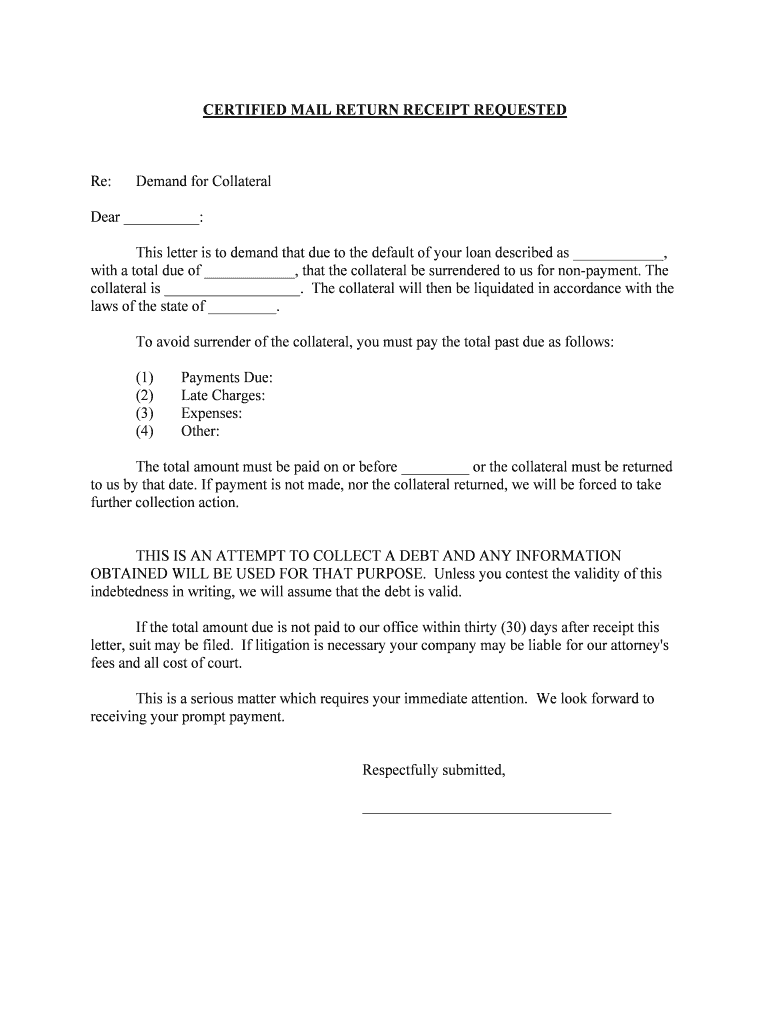

How Do I Get Proof of Certified Mail DeliveryCertified Mail Form Fill

Form by itself and not with your tax return. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Mail it to the address that a form 1040 without payment would go to for your state : Home address (number and street), or p.o. Find out who must file, when and where.

Mail It To The Address That A Form 1040 Without Payment Would Go To For Your State :

Box if mail is not delivered to your home. Form by itself and not with your tax return. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Home address (number and street), or p.o.