Where To Send 8822 Form

Where To Send 8822 Form - If you checked the box on line 2,. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. There are five ways to tell the irs your new address: Form 8822, your tax return, by phone to a local office, in person, by mail. The following replaces the “where to file” addresses on page 2 of form 8822 (rev.

There are five ways to tell the irs your new address: If you checked the box on line 2,. Form 8822, your tax return, by phone to a local office, in person, by mail. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. The following replaces the “where to file” addresses on page 2 of form 8822 (rev.

The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822, your tax return, by phone to a local office, in person, by mail. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. There are five ways to tell the irs your new address: If you checked the box on line 2,.

Irs change address darkinfo

There are five ways to tell the irs your new address: Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. If you checked the box on line 2,. Form 8822, your tax return,.

FORM 8822 AUTOFILL PDF

Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Form 8822, your tax return, by phone to a local office, in person, by mail. If you checked the box on line 2,. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. There.

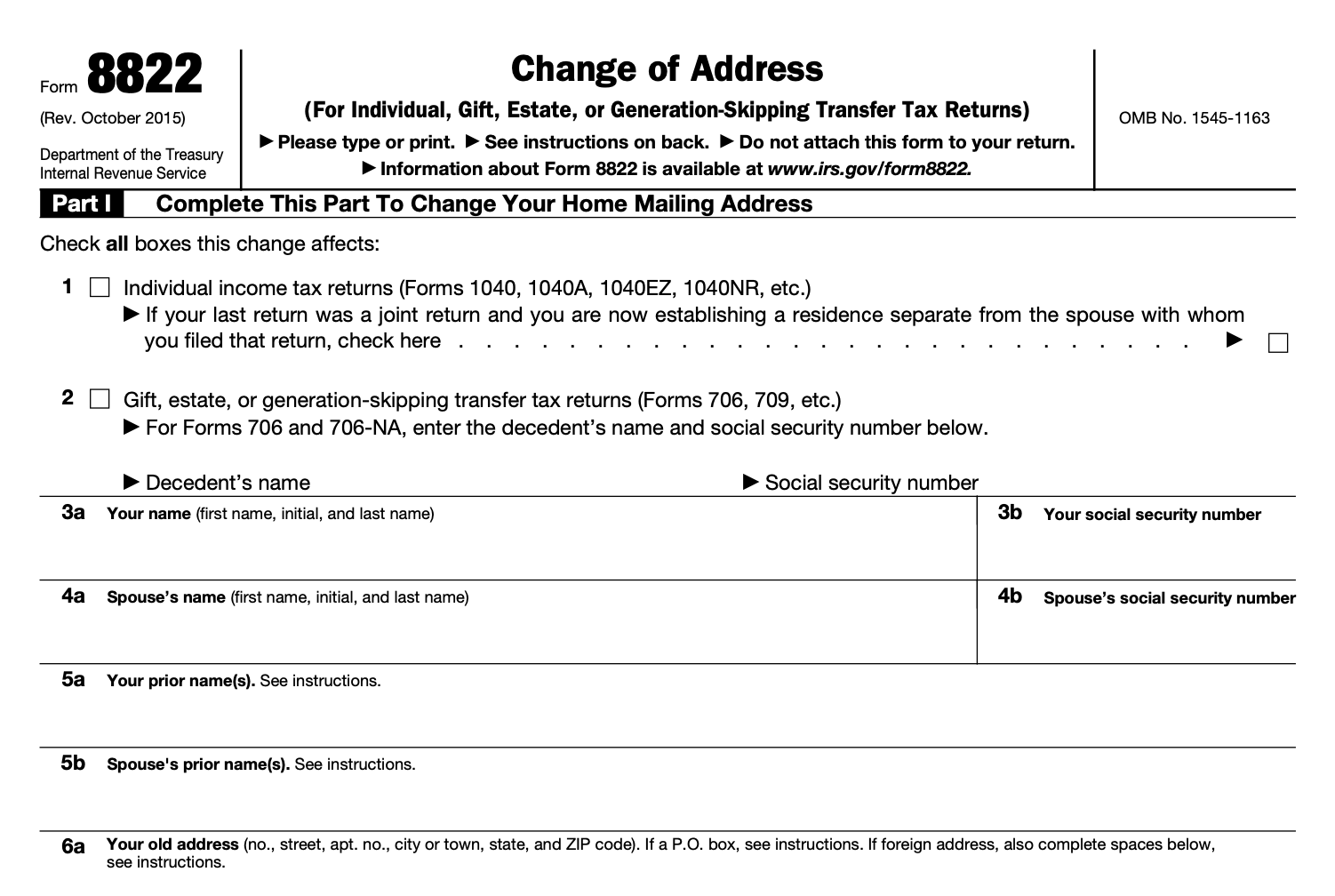

IRS Form 8822 Instructions Changing Your Address With the IRS

There are five ways to tell the irs your new address: Form 8822, your tax return, by phone to a local office, in person, by mail. If you checked the box on line 2,. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822 is used by taxpayers to notify the irs of.

Form 8822Change of Address

Form 8822, your tax return, by phone to a local office, in person, by mail. If you checked the box on line 2,. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. There are five ways to tell the irs your new address: The following replaces the “where.

Form 8822 Edit, Fill, Sign Online Handypdf

The following replaces the “where to file” addresses on page 2 of form 8822 (rev. There are five ways to tell the irs your new address: Form 8822, your tax return, by phone to a local office, in person, by mail. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or.

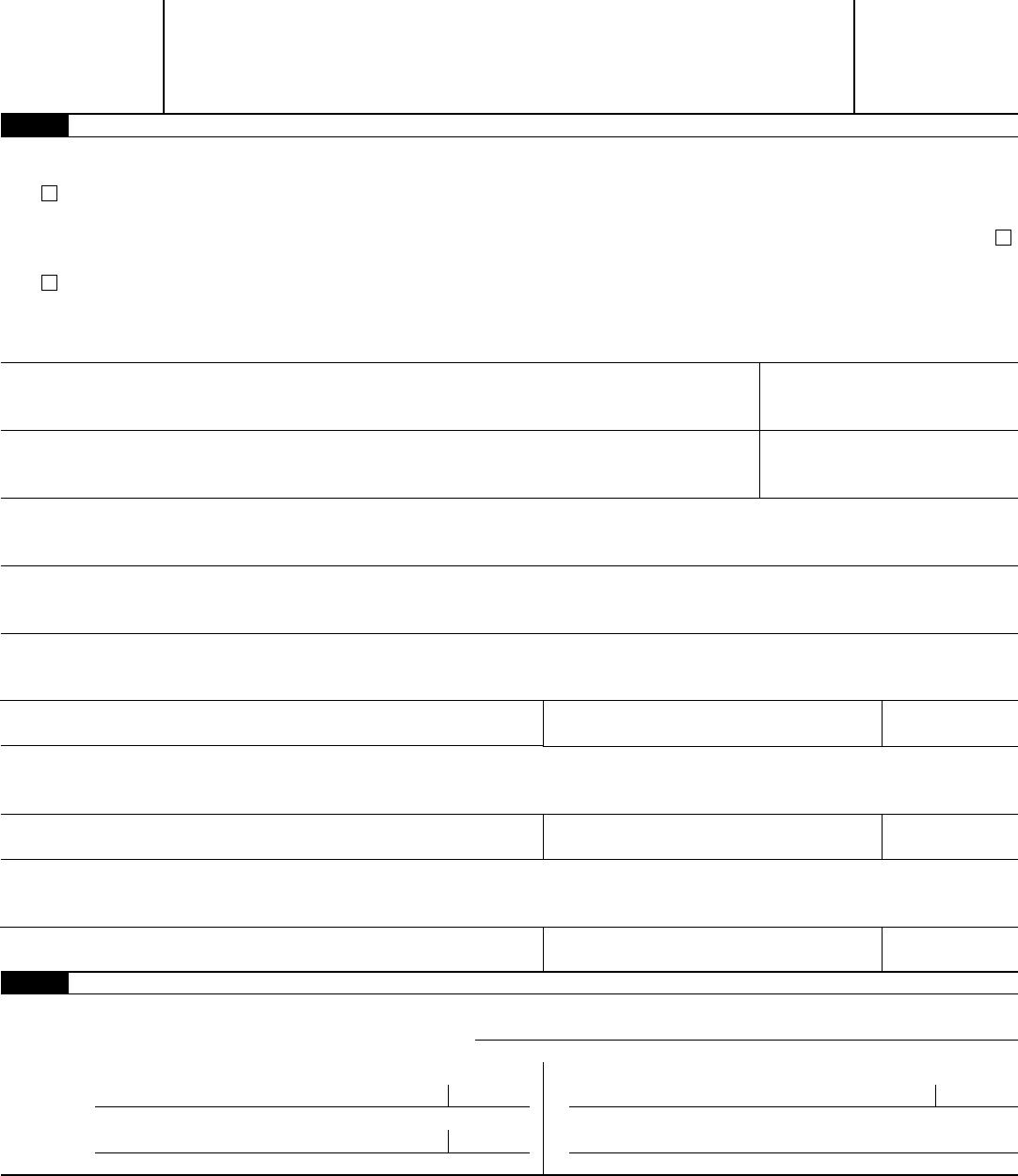

IRS Form 8822B Instructions Change of Address or Party

If you checked the box on line 2,. The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822, your tax return, by phone to a local office, in person, by mail. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. There.

Tax Form 8822B Change of Address blank, online — PDFliner

The following replaces the “where to file” addresses on page 2 of form 8822 (rev. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. If you checked the box on line 2,. Form 8822, your tax return, by phone to a local office, in person, by mail. There.

Form 8822 b 2013 Fill out & sign online DocHub

Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Form 8822, your tax return, by phone to a local office, in person, by mail. There are five ways to tell the irs your new address: If you checked the box on line 2,. The following replaces the “where.

Form 8822 B Complete with ease airSlate SignNow

There are five ways to tell the irs your new address: The following replaces the “where to file” addresses on page 2 of form 8822 (rev. If you checked the box on line 2,. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Form 8822, your tax return,.

How to Fill Out IRS Form 8822 (Change of Address) YouTube

There are five ways to tell the irs your new address: Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Form 8822, your tax return, by phone to a local office, in person, by mail. The following replaces the “where to file” addresses on page 2 of form.

There Are Five Ways To Tell The Irs Your New Address:

If you checked the box on line 2,. Form 8822, your tax return, by phone to a local office, in person, by mail. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. The following replaces the “where to file” addresses on page 2 of form 8822 (rev.