Who Is Exempt From Pennsylvania Local Services Tax

Who Is Exempt From Pennsylvania Local Services Tax - If the total lst rate enacted is $10.00 or less, the. If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income and/or net profits. However, the borough has placed a minimum compensation level making lower income individuals exempt from the tax and eligible to. Political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income and net. To claim an exemption, an individual must annually file an exemption certificate with the political subdivision levying the lst. Employees will have the right to complete a local services tax exemption certificate. Exemption from the tax is granted to any person who is liable and has already paid local services taxes totaling the maximum rate set forth in. Any person whose total earned income and net profits from all sources within the political subdivision is less than $12,000 for the.

Any person whose total earned income and net profits from all sources within the political subdivision is less than $12,000 for the. If the total lst rate enacted is $10.00 or less, the. However, the borough has placed a minimum compensation level making lower income individuals exempt from the tax and eligible to. Political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income and net. Employees will have the right to complete a local services tax exemption certificate. If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income and/or net profits. Exemption from the tax is granted to any person who is liable and has already paid local services taxes totaling the maximum rate set forth in. To claim an exemption, an individual must annually file an exemption certificate with the political subdivision levying the lst.

To claim an exemption, an individual must annually file an exemption certificate with the political subdivision levying the lst. Any person whose total earned income and net profits from all sources within the political subdivision is less than $12,000 for the. Employees will have the right to complete a local services tax exemption certificate. If the total lst rate enacted is $10.00 or less, the. If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income and/or net profits. Political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income and net. However, the borough has placed a minimum compensation level making lower income individuals exempt from the tax and eligible to. Exemption from the tax is granted to any person who is liable and has already paid local services taxes totaling the maximum rate set forth in.

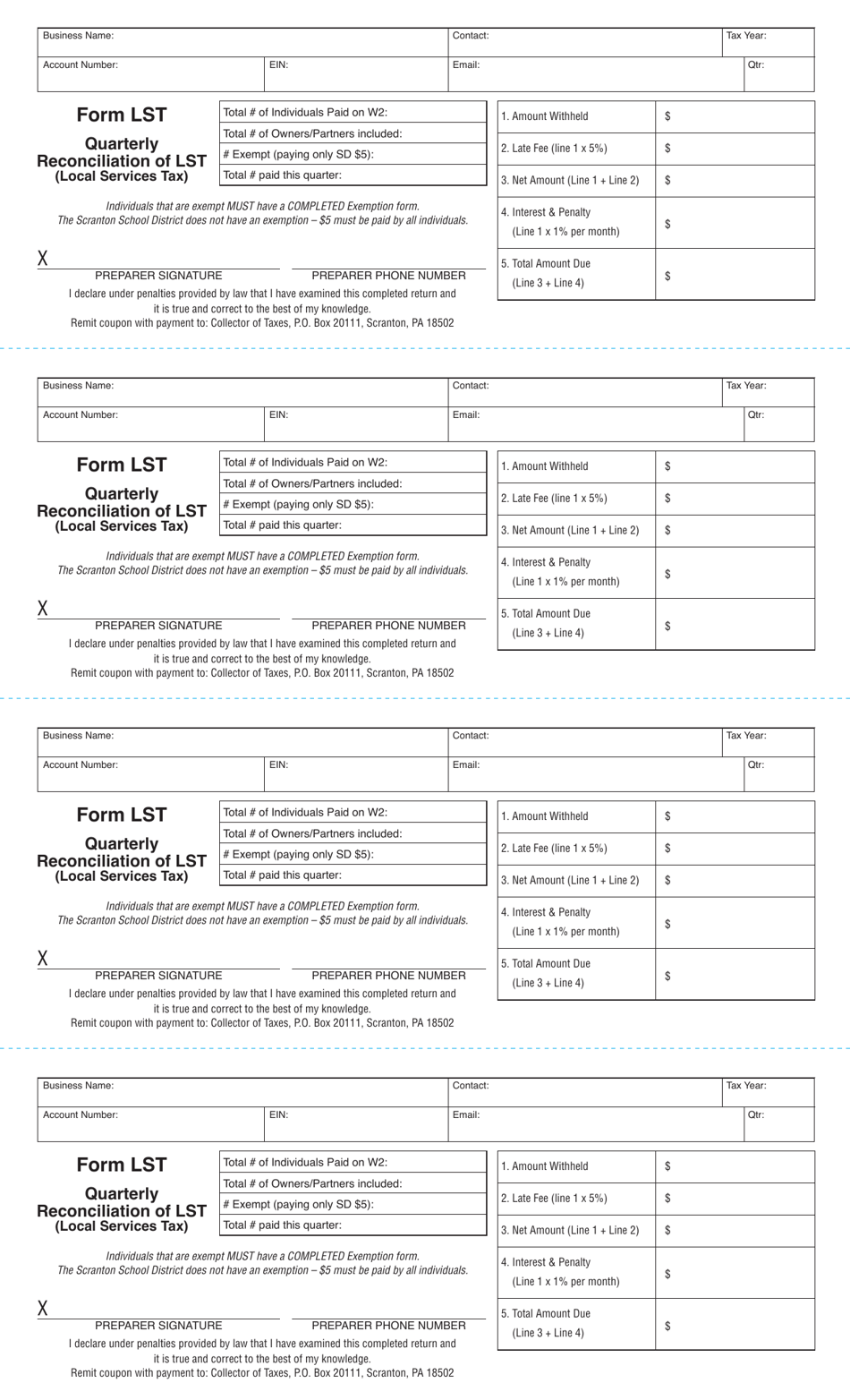

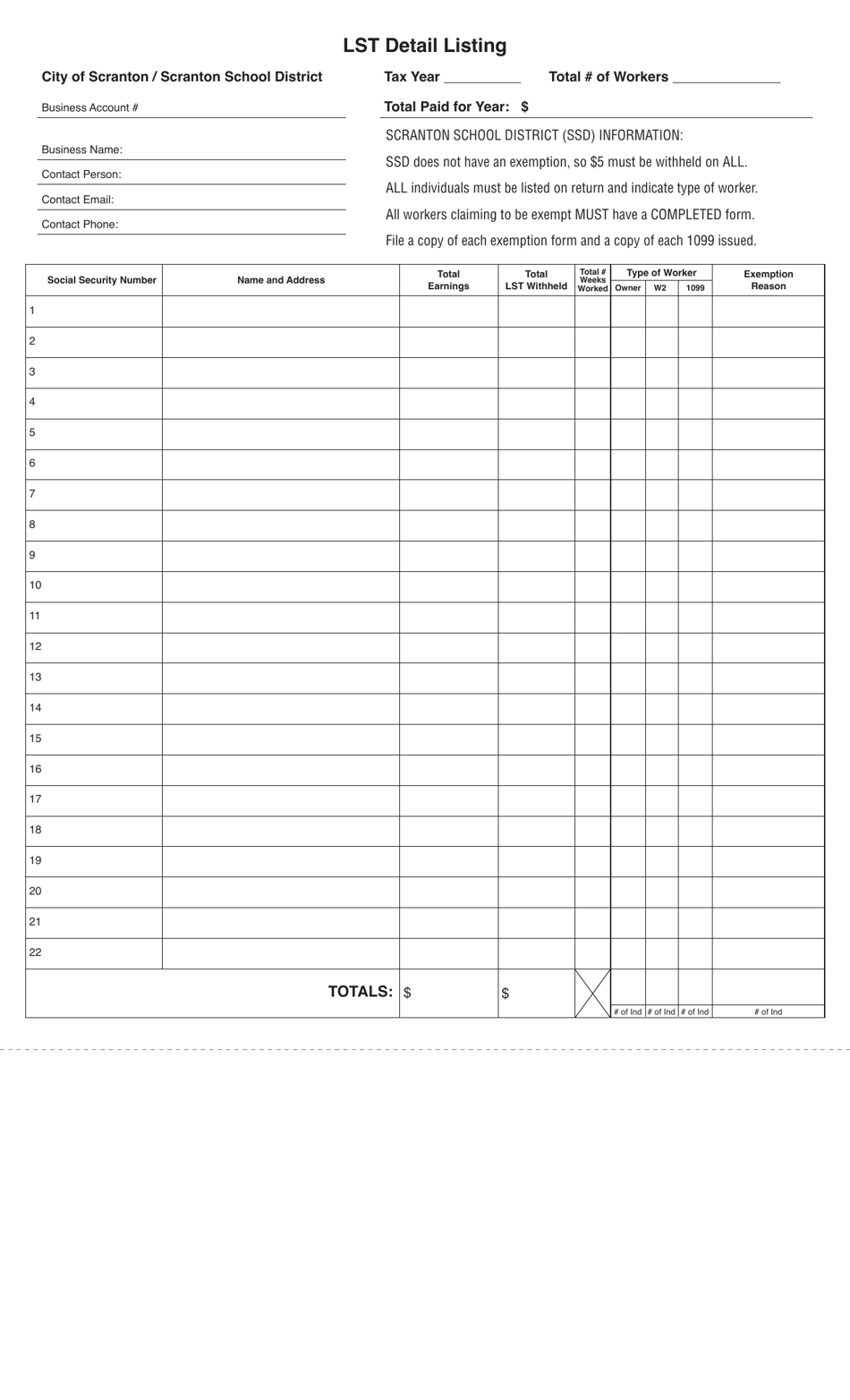

Form LST Fill Out, Sign Online and Download Printable PDF, City of

If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income and/or net profits. If the total lst rate enacted is $10.00 or less, the. To claim an exemption, an individual must annually file an exemption certificate with the political subdivision levying the lst. Employees will have the right to complete a.

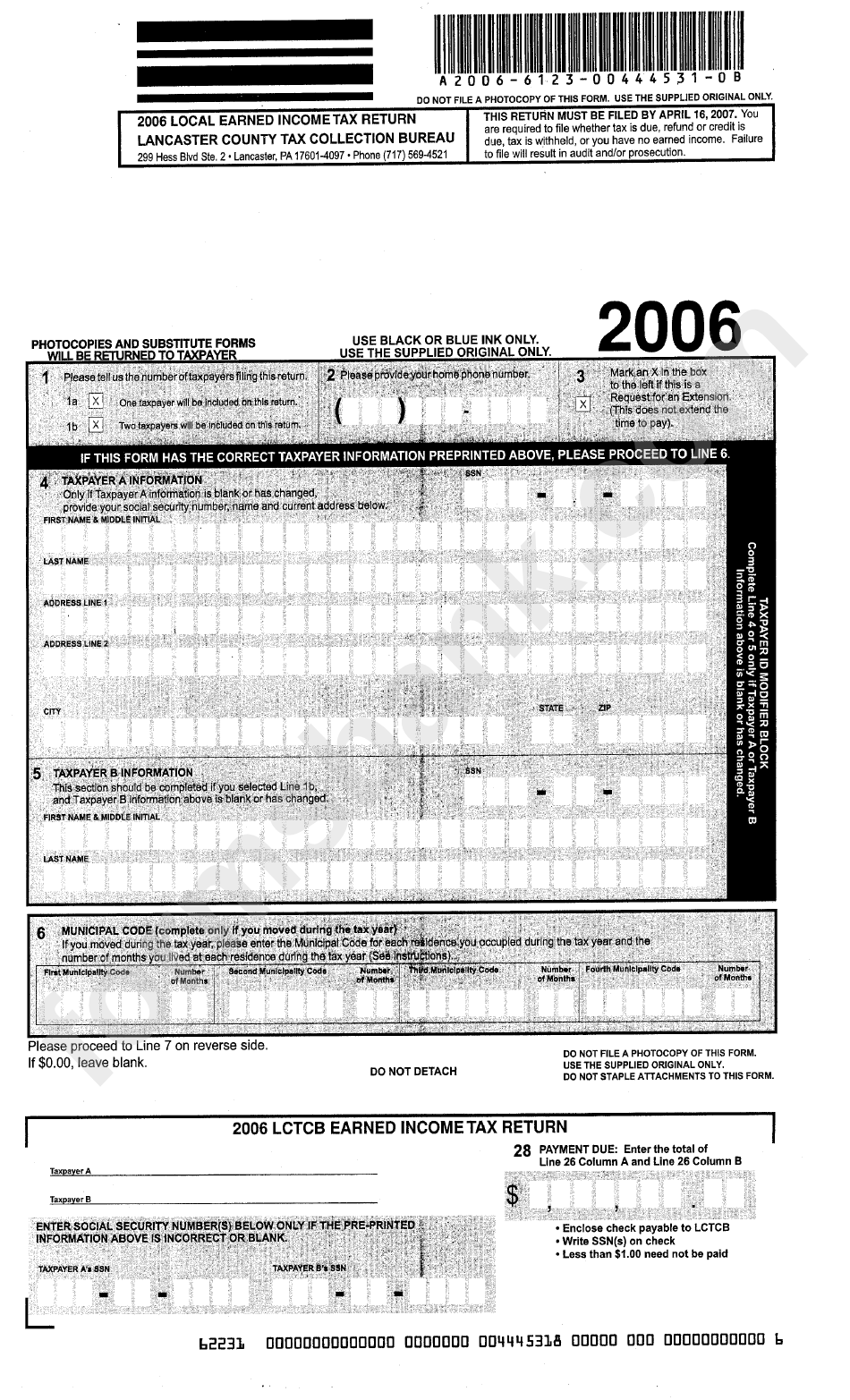

Local Earned Tax Return Form 2006 Lancaster County Tax

To claim an exemption, an individual must annually file an exemption certificate with the political subdivision levying the lst. If the total lst rate enacted is $10.00 or less, the. However, the borough has placed a minimum compensation level making lower income individuals exempt from the tax and eligible to. If the annual tax rate is higher than $10, employees.

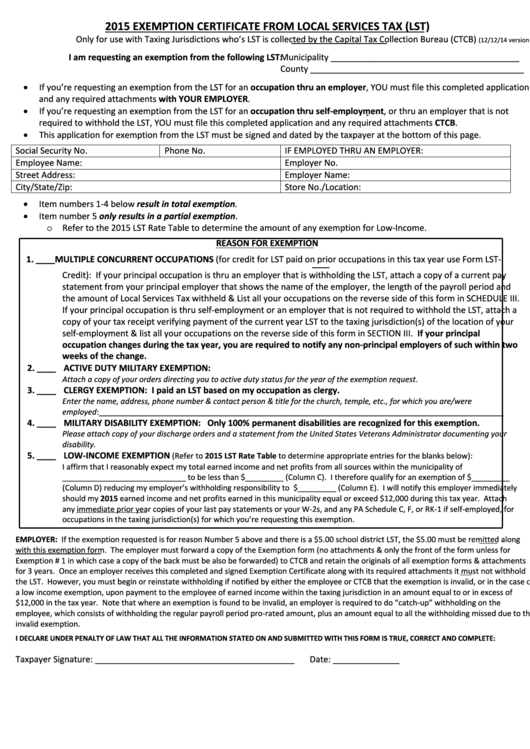

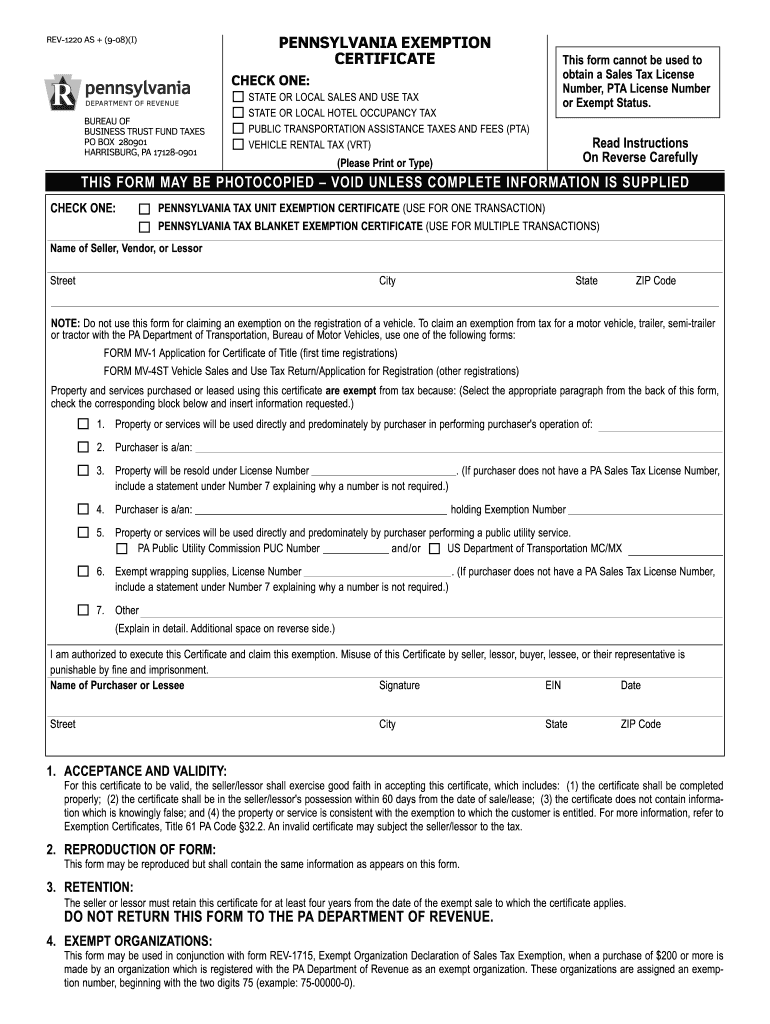

Exemption Certificate From Local Services Tax (Lst) Pennsylvania

If the total lst rate enacted is $10.00 or less, the. Employees will have the right to complete a local services tax exemption certificate. Political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income and net. Exemption from the tax is granted to any person who is liable.

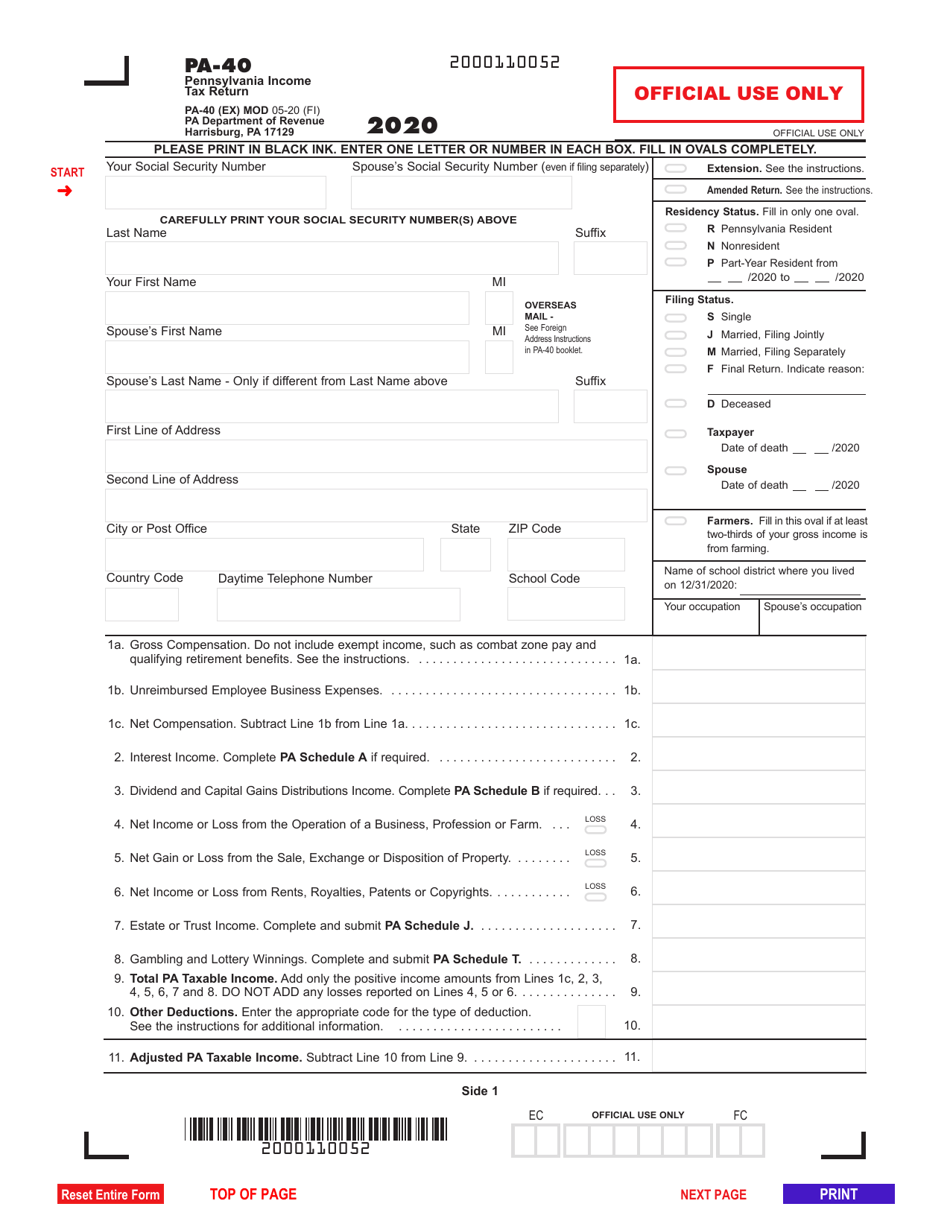

Form PA40 Download Fillable PDF or Fill Online Pennsylvania Tax

To claim an exemption, an individual must annually file an exemption certificate with the political subdivision levying the lst. Exemption from the tax is granted to any person who is liable and has already paid local services taxes totaling the maximum rate set forth in. Employees will have the right to complete a local services tax exemption certificate. If the.

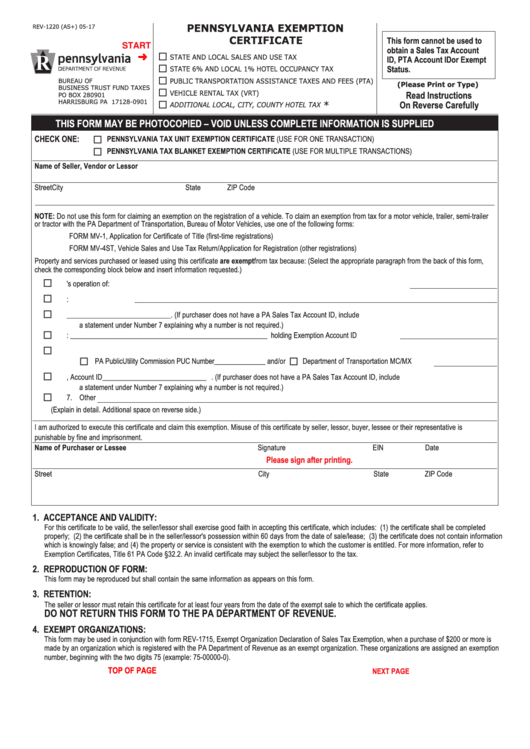

20172024 Form PA REV72 Fill Online, Printable, Fillable, Blank

However, the borough has placed a minimum compensation level making lower income individuals exempt from the tax and eligible to. Exemption from the tax is granted to any person who is liable and has already paid local services taxes totaling the maximum rate set forth in. Employees will have the right to complete a local services tax exemption certificate. If.

Form LST (W3 LST) 2022 Fill Out, Sign Online and Download

Political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income and net. To claim an exemption, an individual must annually file an exemption certificate with the political subdivision levying the lst. Employees will have the right to complete a local services tax exemption certificate. Any person whose total.

Certificate of exemption form Fill out & sign online DocHub

However, the borough has placed a minimum compensation level making lower income individuals exempt from the tax and eligible to. Employees will have the right to complete a local services tax exemption certificate. If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income and/or net profits. Exemption from the tax is.

Pennsylvania State Univeristy Tax Exemption Form

Exemption from the tax is granted to any person who is liable and has already paid local services taxes totaling the maximum rate set forth in. Employees will have the right to complete a local services tax exemption certificate. To claim an exemption, an individual must annually file an exemption certificate with the political subdivision levying the lst. If the.

2023 Tax Exemption Form Pennsylvania

However, the borough has placed a minimum compensation level making lower income individuals exempt from the tax and eligible to. Political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income and net. If the total lst rate enacted is $10.00 or less, the. Exemption from the tax is.

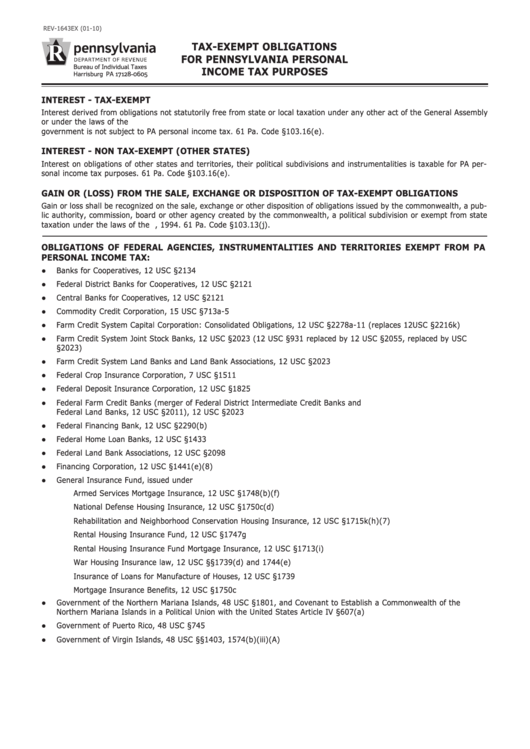

Form Rev1643ex TaxExempt Obligations For Pennsylvania Personal

If the total lst rate enacted is $10.00 or less, the. Political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income and net. To claim an exemption, an individual must annually file an exemption certificate with the political subdivision levying the lst. Any person whose total earned income.

However, The Borough Has Placed A Minimum Compensation Level Making Lower Income Individuals Exempt From The Tax And Eligible To.

To claim an exemption, an individual must annually file an exemption certificate with the political subdivision levying the lst. Exemption from the tax is granted to any person who is liable and has already paid local services taxes totaling the maximum rate set forth in. Employees will have the right to complete a local services tax exemption certificate. If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income and/or net profits.

Political Subdivisions That Levy An Lst At A Rate That Exceeds $10 Must Exempt From The Tax Taxpayers Whose Total Earned Income And Net.

Any person whose total earned income and net profits from all sources within the political subdivision is less than $12,000 for the. If the total lst rate enacted is $10.00 or less, the.