Why Do I Have To File Form 8862

Why Do I Have To File Form 8862 - You only need to file form 8862 if both of the following apply: Your eic or another listed credit was reduced or disallowed on a tax return for a year. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You must file form 8862. You may be asked to. You must attach the applicable schedules and forms to your return for each credit you claim. Taxpayers complete form 8862 and attach it to their tax return if:

You must file form 8862. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You must attach the applicable schedules and forms to your return for each credit you claim. Taxpayers complete form 8862 and attach it to their tax return if: Your eic or another listed credit was reduced or disallowed on a tax return for a year. You only need to file form 8862 if both of the following apply: You may be asked to.

Taxpayers complete form 8862 and attach it to their tax return if: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Your eic or another listed credit was reduced or disallowed on a tax return for a year. You only need to file form 8862 if both of the following apply: You must file form 8862. You must attach the applicable schedules and forms to your return for each credit you claim. You may be asked to.

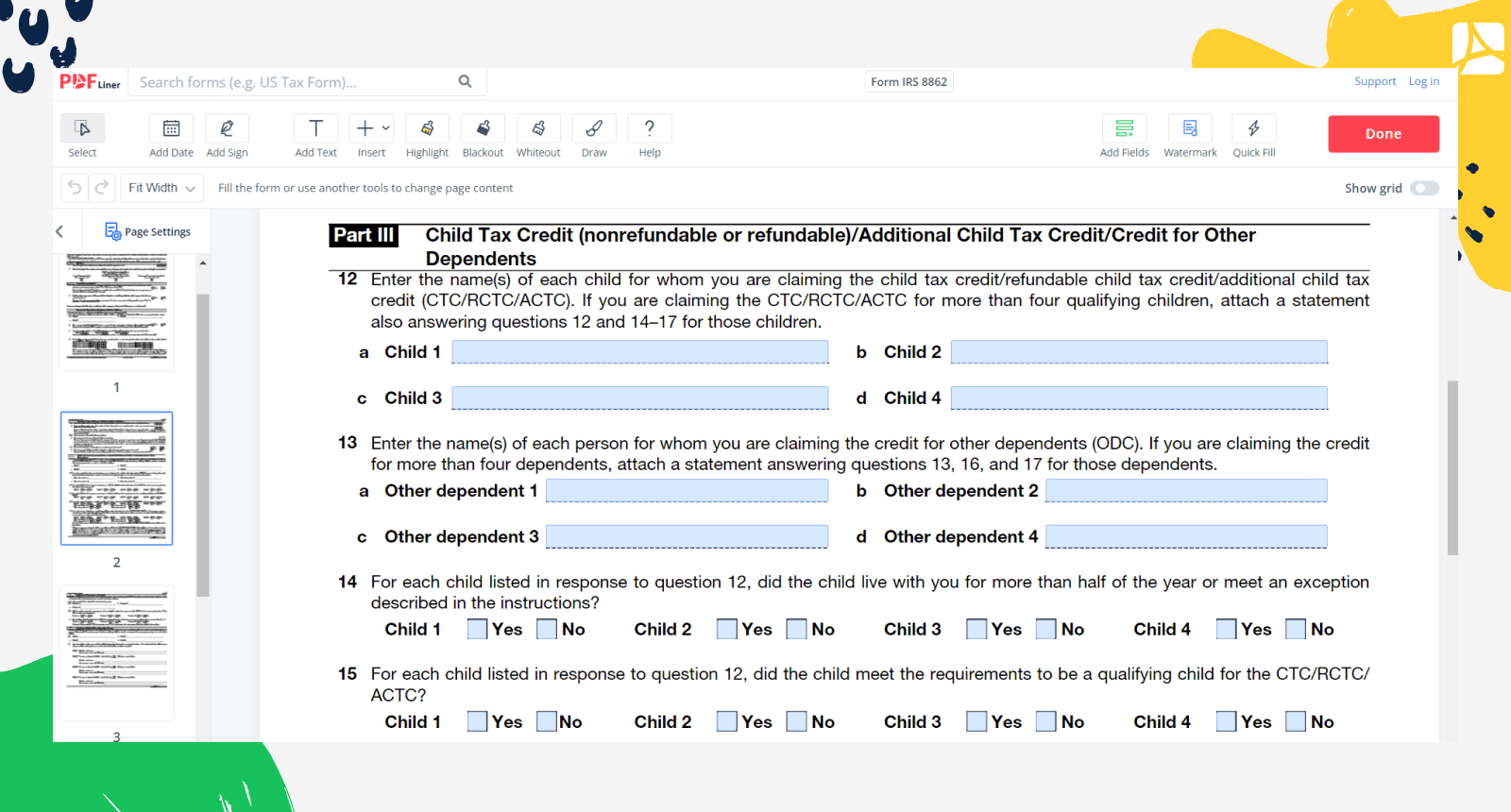

Form 8862 IRS Form 8862 PDF blank, sign forms online — PDFliner

You only need to file form 8862 if both of the following apply: You must file form 8862. Taxpayers complete form 8862 and attach it to their tax return if: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You may be asked to.

IRS Form 8862 ≡ Fill Out Printable PDF Forms Online

Taxpayers complete form 8862 and attach it to their tax return if: You may be asked to. You only need to file form 8862 if both of the following apply: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Your eic or another listed credit was reduced or disallowed on a tax return for a year.

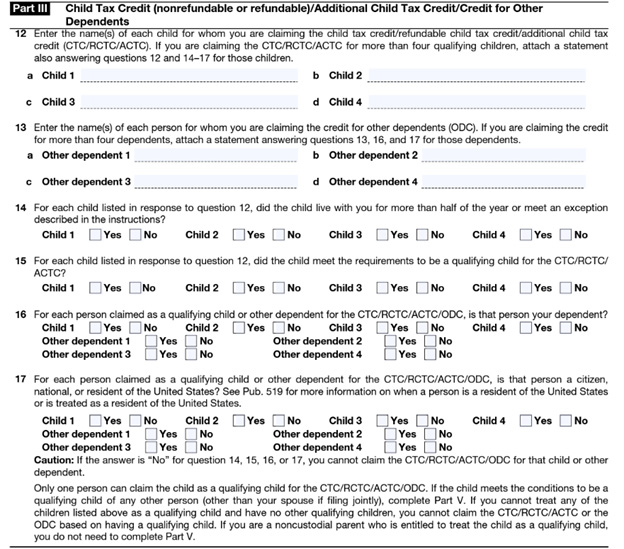

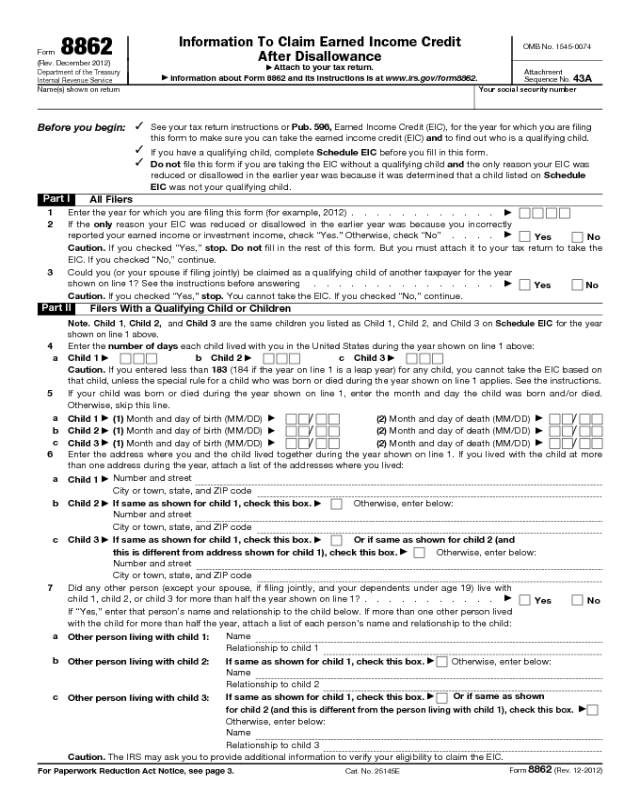

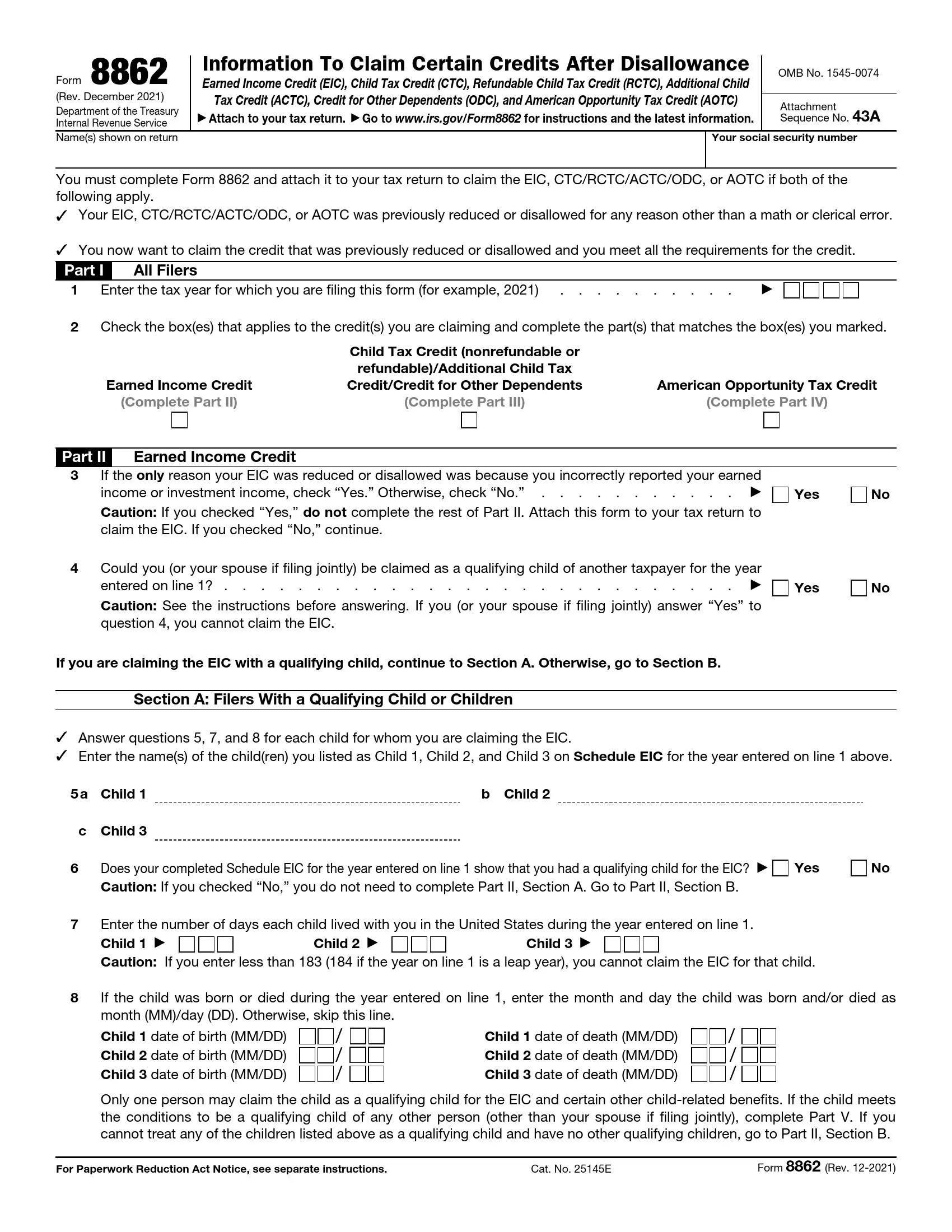

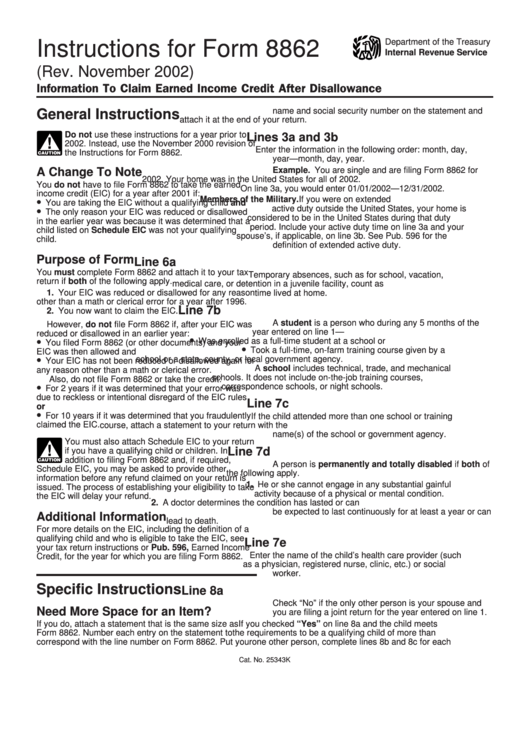

Instructions For Form 8862 Information To Claim Earned Credit

You must attach the applicable schedules and forms to your return for each credit you claim. You only need to file form 8862 if both of the following apply: You may be asked to. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Taxpayers complete form 8862 and attach it to their tax return if:

What Is IRS Form 8862?

You only need to file form 8862 if both of the following apply: You must attach the applicable schedules and forms to your return for each credit you claim. You may be asked to. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You must file form 8862.

Form IRS 8862 Printable and Fillable forms online — PDFliner

Taxpayers complete form 8862 and attach it to their tax return if: You may be asked to. You only need to file form 8862 if both of the following apply: You must attach the applicable schedules and forms to your return for each credit you claim. Your eic or another listed credit was reduced or disallowed on a tax return.

IRS Form 8862 Diagram Quizlet

You must file form 8862. You only need to file form 8862 if both of the following apply: Taxpayers complete form 8862 and attach it to their tax return if: You must attach the applicable schedules and forms to your return for each credit you claim. Your eic or another listed credit was reduced or disallowed on a tax return.

How to Complete IRS Form 8862

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Your eic or another listed credit was reduced or disallowed on a tax return for a year. You may be asked to. You only need to file form 8862 if both of the following apply: You must file form 8862.

What Is An 8862 Tax Form? SuperMoney

Your eic or another listed credit was reduced or disallowed on a tax return for a year. You may be asked to. Taxpayers complete form 8862 and attach it to their tax return if: You must attach the applicable schedules and forms to your return for each credit you claim. You only need to file form 8862 if both of.

How And When To File Form 8862 I Have Attorney Working On Last Years Taxes

Your eic or another listed credit was reduced or disallowed on a tax return for a year. You must attach the applicable schedules and forms to your return for each credit you claim. You must file form 8862. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You may be asked to.

Fillable Form 8862 Printable Forms Free Online

You may be asked to. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Your eic or another listed credit was reduced or disallowed on a tax return for a year. You must attach the applicable schedules and forms to your return for each credit you claim. You only need to file form 8862 if both.

You Must File Form 8862.

You may be asked to. You must attach the applicable schedules and forms to your return for each credit you claim. You only need to file form 8862 if both of the following apply: Your eic or another listed credit was reduced or disallowed on a tax return for a year.

Their Earned Income Credit (Eic), Child Tax Credit (Ctc)/Additional Child Tax Credit (Actc),.

Taxpayers complete form 8862 and attach it to their tax return if:

:max_bytes(150000):strip_icc()/2022-01-1111_48_02-Form8862Rev.December2021-f23f0eab085a467eb521f33bd3758904.jpg)