Will Filing Bankruptcy Affect My Tax Refund

Will Filing Bankruptcy Affect My Tax Refund - If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing. Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax.

If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing. Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax.

Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax. If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing.

Learn How You Can File Bankruptcy and Keep Your Tax Refund Wynn at

Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax. If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing.

Should You Consider Filing For Bankruptcy? Tax Relief Center

If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing. Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax.

Bankruptcy and My Tax Refund

Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax. If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing.

How Will My Spouse's Bankruptcy Filing Affect Me?

If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing. Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax.

Learn How You Can File Bankruptcy and Keep Your Tax Refund Wynn at

If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing. Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax.

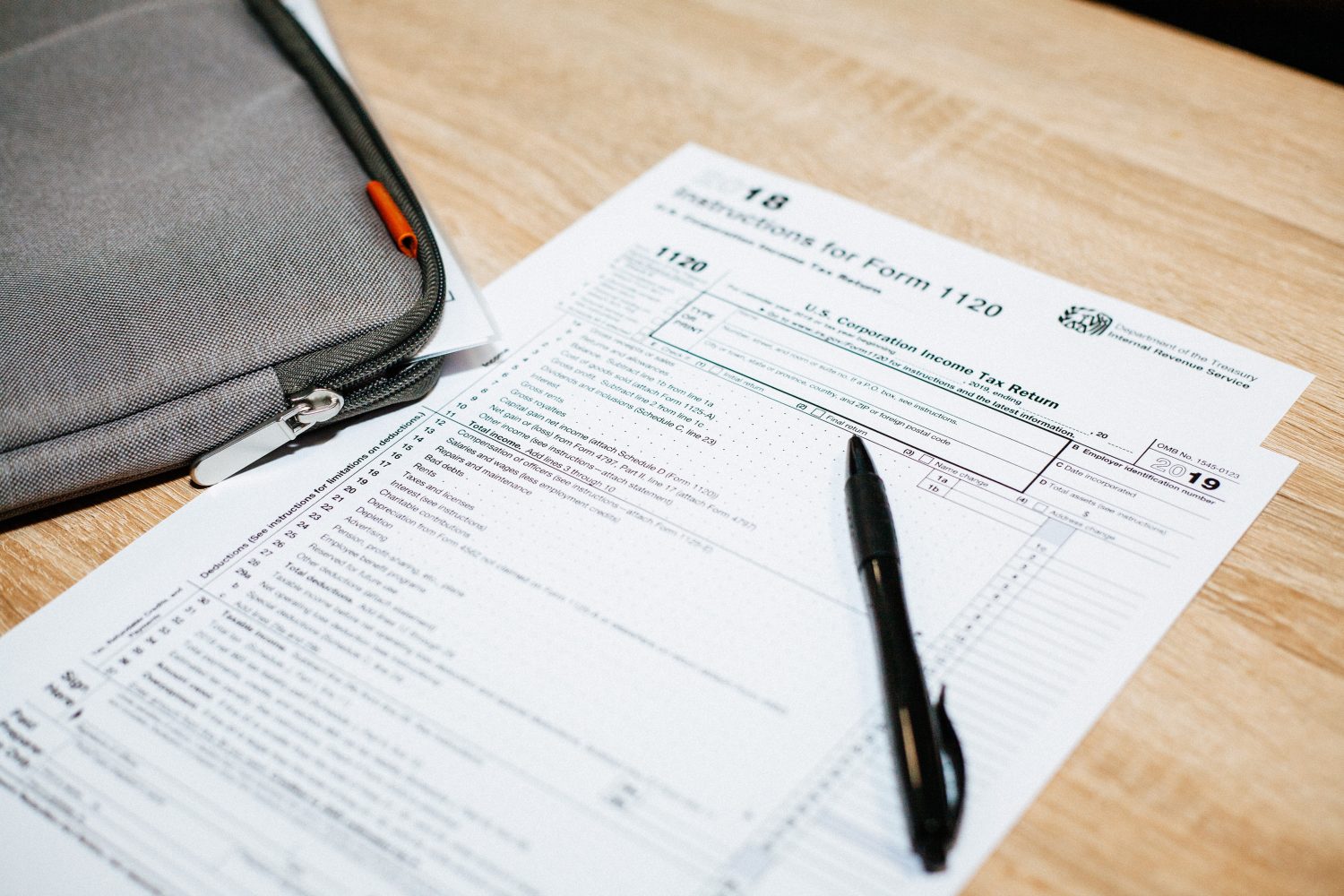

How Does Bankruptcy Affect Your Tax Refund in Arizona? Tax Refunds

Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax. If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing.

Learn How You Can File Bankruptcy and Keep Your Tax Refund Wynn at

Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax. If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing.

Will Filing Bankruptcy Affect My Children? Ohio Bankruptcy Attorneys

If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing. Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax.

What happens to my tax refund in Bankruptcy EZ Oklahoma Bankruptcy

Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax. If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing.

Can I Keep My Tax Refund After Filing Chapter 7? Cibik Law

If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing. Even if you are unsure how bankruptcy will impact your taxes, it’s important to continue filing annual tax.

Even If You Are Unsure How Bankruptcy Will Impact Your Taxes, It’s Important To Continue Filing Annual Tax.

If you file for bankruptcy before receiving your tax refund, the trustee may seize all or part of the refund, depending on the timing.