City Of Pittsburgh Local Tax

City Of Pittsburgh Local Tax - If the employer does not withhold the proper amount of tax, then the employee, partner, or self. All owners of real estate located within the city and school district. The market value of the property is determined by the allegheny county office of. Since 2012, employers in pennsylvania have been required to withhold employees' local earned income taxes much like state and federal income taxes. Real estate tax is tax collected by the city. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Find your withholding rates by address. The annual local service tax reconciliation is not being required for 2023 or 2024. Local services tax exemption certificate. The local services tax may be levied, assessed and collected by the political.

Since 2012, employers in pennsylvania have been required to withhold employees' local earned income taxes much like state and federal income taxes. Real estate tax is tax collected by the city. Find your withholding rates by address. The local services tax may be levied, assessed and collected by the political. Local services tax exemption certificate. All owners of real estate located within the city and school district. The annual local service tax reconciliation is not being required for 2023 or 2024. If the employer does not withhold the proper amount of tax, then the employee, partner, or self. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. The market value of the property is determined by the allegheny county office of.

The local services tax may be levied, assessed and collected by the political. Since 2012, employers in pennsylvania have been required to withhold employees' local earned income taxes much like state and federal income taxes. Find your withholding rates by address. If the employer does not withhold the proper amount of tax, then the employee, partner, or self. The market value of the property is determined by the allegheny county office of. All owners of real estate located within the city and school district. Real estate tax is tax collected by the city. The annual local service tax reconciliation is not being required for 2023 or 2024. Local services tax exemption certificate. The local services tax of $52 is to be deducted evenly from pay checks throughout the year.

City of Pittsburgh

Local services tax exemption certificate. If the employer does not withhold the proper amount of tax, then the employee, partner, or self. The annual local service tax reconciliation is not being required for 2023 or 2024. All owners of real estate located within the city and school district. The local services tax of $52 is to be deducted evenly from.

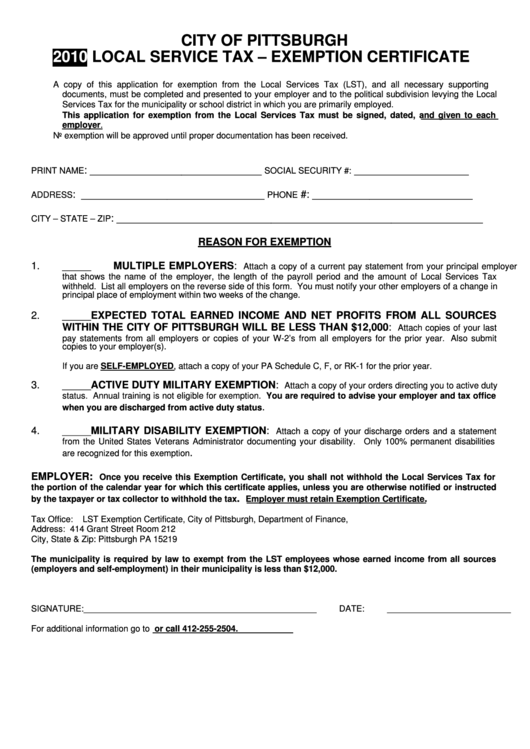

Local Service Tax Exemption Certificate City Of Pittsburgh 2010

Local services tax exemption certificate. The annual local service tax reconciliation is not being required for 2023 or 2024. The local services tax may be levied, assessed and collected by the political. If the employer does not withhold the proper amount of tax, then the employee, partner, or self. The local services tax of $52 is to be deducted evenly.

2023 City of Pittsburgh Tax Receipt Taxpayer Receipt

Find your withholding rates by address. The local services tax may be levied, assessed and collected by the political. The annual local service tax reconciliation is not being required for 2023 or 2024. The market value of the property is determined by the allegheny county office of. Real estate tax is tax collected by the city.

Looking for things to do this weekend in Pittsburgh? 👀 Don’t worry we

The annual local service tax reconciliation is not being required for 2023 or 2024. The market value of the property is determined by the allegheny county office of. If the employer does not withhold the proper amount of tax, then the employee, partner, or self. All owners of real estate located within the city and school district. Since 2012, employers.

City of Pittsburgh

Since 2012, employers in pennsylvania have been required to withhold employees' local earned income taxes much like state and federal income taxes. Real estate tax is tax collected by the city. All owners of real estate located within the city and school district. Local services tax exemption certificate. Find your withholding rates by address.

Slightly late on local taxes? Pittsburghers may see some

Since 2012, employers in pennsylvania have been required to withhold employees' local earned income taxes much like state and federal income taxes. The annual local service tax reconciliation is not being required for 2023 or 2024. If the employer does not withhold the proper amount of tax, then the employee, partner, or self. The local services tax of $52 is.

January 1 Transfer Tax Increase will Give Pittsburgh Highest Rate in U

Real estate tax is tax collected by the city. All owners of real estate located within the city and school district. Since 2012, employers in pennsylvania have been required to withhold employees' local earned income taxes much like state and federal income taxes. If the employer does not withhold the proper amount of tax, then the employee, partner, or self..

Local lawmakers to introduce property tax relief bills for Pittsburgh

Find your withholding rates by address. Local services tax exemption certificate. Real estate tax is tax collected by the city. Since 2012, employers in pennsylvania have been required to withhold employees' local earned income taxes much like state and federal income taxes. The local services tax may be levied, assessed and collected by the political.

ptrrealtytax122017

If the employer does not withhold the proper amount of tax, then the employee, partner, or self. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Find your withholding rates by address. The annual local service tax reconciliation is not being required for 2023 or 2024. The market value of the property.

News Archives Pittsburgh Innovation District

All owners of real estate located within the city and school district. Find your withholding rates by address. Local services tax exemption certificate. The local services tax may be levied, assessed and collected by the political. Since 2012, employers in pennsylvania have been required to withhold employees' local earned income taxes much like state and federal income taxes.

Local Services Tax Exemption Certificate.

Real estate tax is tax collected by the city. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Since 2012, employers in pennsylvania have been required to withhold employees' local earned income taxes much like state and federal income taxes. The annual local service tax reconciliation is not being required for 2023 or 2024.

If The Employer Does Not Withhold The Proper Amount Of Tax, Then The Employee, Partner, Or Self.

The local services tax may be levied, assessed and collected by the political. The market value of the property is determined by the allegheny county office of. Find your withholding rates by address. All owners of real estate located within the city and school district.